Life Insurance

Children’s Plan

Make your children happy and secure their life & future

Planning for your children’s education or marriage or higher studies is achieved by children plans.

In Children’s plans the benefits at certain period of the term of policy is payable to the insured irrespective of the parents survival or death.

This also pays for the death benefit of the insured in between the policy period apart from paying the survival benefits to the need of your child. Children’s plans comes with option of both with market risks(unit linked schemes) and without market risks(traditional).

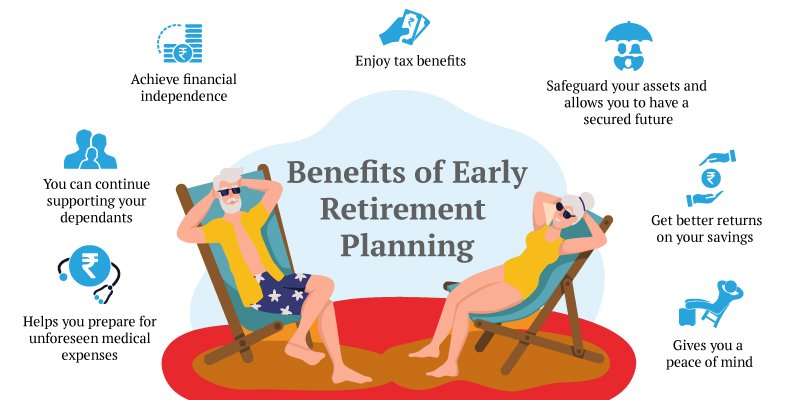

Retirement Plan

Enter Your Golden Years in Style.

Retirement happens to be an inevitable part of most of our lives. Some people are smitten by the word Retirement, while there is one such lot that has heavy dislike for this word.

Individuals in the favour of Retirement view it as one such period in their life that allows them to spend some quality time with their family and friends. However, the group that is not so much in favour of Retirement view this stage as a period of financial crunch. The moral of the story however remains that post retirement regular inflow of income is obstructed and thus it is vital to enjoy sufficient financial back-up. It is this back up that the Pension Policy is believed to provide.

Endowment Plan

Attractive combination of protection and saving features

Endowment plans are typical savings plans suited for those who need only guaranteed benefit after a certain period of term without any market risks.

In simple means these are suited for conservative investors.

However the bonus( share of returns what the insurance companies make with this policy premiums) varies according to the investment returns of the company though the sum insured is guaranteed.

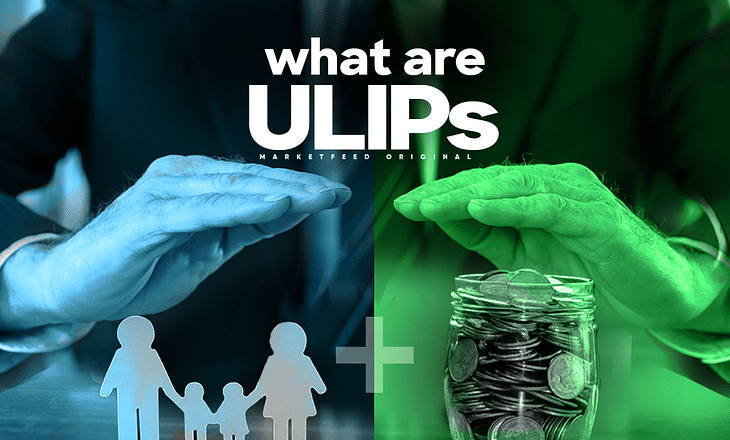

ULIP Plan

Maximise Returns on Your Investments

Commonly known as ULIP’S are best suited for those who need a perfect blend equity exposure and certain amount of risk coverage.

ULIP’s have different fund options according to the risk appetite of the investor such as aggressive equity funds ( which predominantly invests a major portion of premium in equities), balanced funds ( which is a mix of equity and cash equivalent options, gilts, bonds etc),conservative funds with relatively low equity composition.